Equinor ASA (EQNR) Quarterly Earnings Outlook and Financial Review

Equinor ASA (EQNR) Quarterly Earnings Outlook and Financial Review

Equinor ASA | NYSE: EQNR

Research Report | February 4, 2025

Company Overview Equinor ASA (NYSE: EQNR) is a leading international energy company based in Norway. Formerly known as Statoil, Equinor rebranded in 2018 to reflect its strategic shift towards renewable energy and sustainability. The company operates in over 30 countries and is engaged in oil and gas exploration, production, refining, and renewable energy projects, including offshore wind, hydrogen, and carbon capture technologies.

Financial Performance Equinor has demonstrated strong financial results in recent years, driven by stable oil and gas production, operational efficiency, and a focus on capital discipline.

-

Q3 2024 Financials:

-

Adjusted Operating Income: $6.89 billion

-

Net Income: $2.29 billion

-

Total Production: 1.98 million barrels of oil equivalent per day

-

Year-over-Year Decline: 13% due to lower oil prices and reduced output

-

-

Full Year 2023 Financials:

-

Production Growth: 2.1% increase compared to 2022

-

Strong free cash flow and dividend distribution to shareholders

-

Quarterly Earnings Preview Equinor is set to release its Q4 2024 earnings report on February 5, 2025, with analysts expecting the following key metrics:

-

Projected Adjusted Operating Income: Between $6.5 billion and $7.0 billion

-

Estimated Net Income: Around $2.1 billion, reflecting continued market fluctuations

-

Expected Production: Slight increase in oil and gas output due to efficiency improvements and higher seasonal demand

-

Market Outlook: Investors are closely watching price trends, OPEC+ decisions, and global energy demand to gauge Equinor's performance

Strategic Initiatives Equinor is actively restructuring its portfolio to focus on core regions such as Norway, the U.S. Gulf of Mexico, and Brazil. At the same time, it is expanding investments in renewable and low-carbon energy projects.

-

Oil & Gas Developments:

-

Exited Suriname operations in August 2024, transferring exploration block interests to Hess Corp.

-

Continued production optimization in the Johan Sverdrup field, one of the largest oil discoveries in Norway.

-

-

Renewable Energy Expansion:

-

Offshore Wind: Investing in large-scale offshore wind projects, including Dogger Bank in the UK, the world’s largest offshore wind farm.

-

Hydrogen & CCS: Advancing low-carbon hydrogen projects and carbon capture & storage (CCS) to align with global net-zero targets.

-

Stock Performance

-

Stock Price (as of February 4, 2025): $23.81 per share

-

Recent Performance: Slight decline (-0.67%) reflecting market fluctuations

-

Dividend Yield: Consistently attractive returns to shareholders

Financial Analysis

-

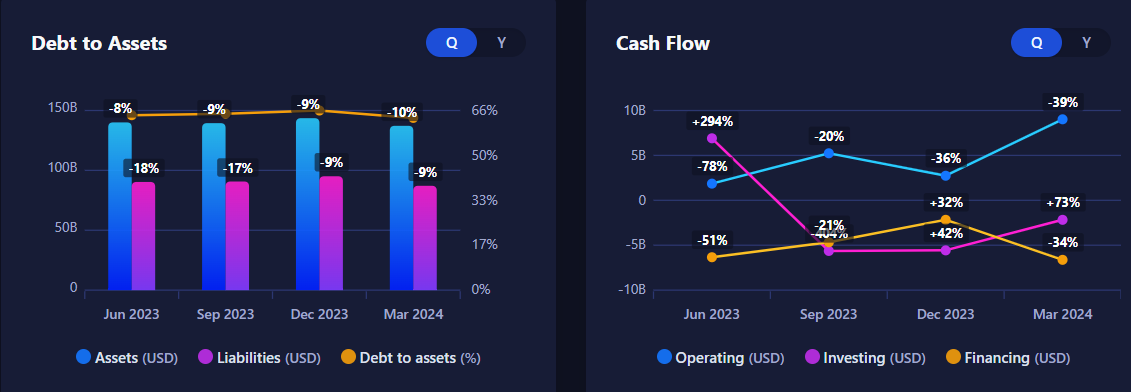

Liquidity & Cash Flow: Equinor maintains strong liquidity with a robust cash position supporting dividends and buybacks.

-

Debt Levels: Managed debt-to-equity ratio, with capital expenditures aligned to growth strategies.

-

Valuation Metrics: Forward price-to-earnings (P/E) ratio remains competitive within the energy sector, providing attractive investment potential.

Challenges & Risks

-

Oil Price Volatility: Equinor’s earnings are significantly impacted by fluctuations in global oil and gas prices.

-

Project Delays: Renewable energy project setbacks, such as delays in Dogger Bank A, may affect long-term growth projections.

-

Regulatory & Environmental Risks: Compliance with increasing regulations in emissions reduction and energy transition policies.

Outlook & Conclusion Equinor trading at $23.81 is well-positioned for long-term growth through its dual focus on traditional energy production and expanding renewables. Despite challenges such as price volatility and project delays, its disciplined capital strategy and commitment to sustainability make it a solid investment in the evolving energy landscape. Investors should monitor oil price trends, regulatory shifts, and renewable energy developments for future performance insights. At Buttonwoodedge, we have recommended a "moderate buy" on the stock with a mid-term to long term focus.

Disclaimer: The information provided by Buttonwoodedge Consulting Ltd is intended as general information or an overview and does not consider your personal objectives, circumstances, or needs. Investment decisions are significant and should be made with care. If you are unsure about making a decision based on the analysis or overview presented in our reports, we recommend seeking personalized advice from a licensed adviser. Buttonwoodedge Consulting Ltd disclaims any liability for losses or damages resulting from actions taken based on this information.

RECENT POST

- Nvidia Eyes the Quantum Leap…

- U.S. Futures Slip as Markets…

- Byrna Technologies Delivers Impressive Q1,…

- Crocs, Inc. (NASDAQ: CROX): A…

- Norwegian Cruise Line Holdings (NCLH):…

- "Wendy's (NYSE: WEN) Sees Steady…

- Federal Reserve Chair Jerome Powell’s…

- Equinor ASA (EQNR) Quarterly Earnings…

- Trump Signs Historic Bill to…

- Markets Respond to Trump's New…

- Mattel (NASDAQ: MAT): Resilient Growth,…

- Magnite Inc. (NASDAQ: MGNI): A…

- Trump Unveils $500 Billion AI…

- Rising Demand for VanEck Defense…

- In-Depth Analysis of Pinterest (NYSE:…

- Marathon Digital Holdings (NASDAQ: MARA)…

- Trump’s Return to Office on…

- Novo Nordisk (NYSE: NVO) Drives…

- Is Semrush Holdings, Inc. (NYSE:SEMR)…

- Woodside Energy (ASX:WDS) Reports Strong…

- SoFi Technologies Inc (NASDAQ:SOFI): Redefining…

- British American Tobacco (LON:BATS) Reports…

- Jimmy Carter's Presidency: A Legacy…

- US Stocks Decline Amid Profit-Taking…

- Upcoming Quarterly Earnings and Growth…

- Outlook for the US stock…

- British Equities Rise Amid Hopes…

- A world in Flux -…

- Why Capital Growth is Crucial…

- September 10th 2024 - Oil…

- Global M&A in 2H: A…

- Global stock markets take a…

- General Analysis of Adicet Bio,…

- On 22 May 2024 Nvidia…

- Copyright © 2025 Buttonwood Edge All Rights Reserved