Magnite Inc. (NASDAQ: MGNI): A Leading Player in Programmatic Advertising and CTV with Strong Growth Potential

Magnite Inc. (NASDAQ: MGNI): A Leading Player in Programmatic Advertising and CTV with Strong Growth Potential

Magnite Inc. | NASDAQ: MGNI

Research Report | January 21 2025

Company Overview: Magnite Inc. (NASDAQ: MGNI) is a leading independent sell-side advertising technology platform that offers comprehensive solutions for publishers, brands, and advertisers across digital media. It was formed as a result of the merger between Rubicon Project and Telaria in April 2020, combining their strengths in display advertising, video, and CTV (Connected TV) advertising. Magnite enables publishers to monetize their digital inventory through a programmatic advertising exchange that provides ad placement in real-time through auctions.

Magnite primarily serves the needs of digital media owners, offering a unified solution to manage ad inventory, optimize ad monetization, and improve performance across various advertising formats, including display, video, and CTV.

Key Business Segments: Magnite operates in two primary business segments:

-

Supply-Side Platform (SSP): This is the core of Magnite’s business. It helps publishers manage and optimise their ad inventories through programmatic auctions. The platform connects publishers with a wide range of demand sources and helps them maximise yield from their ad spaces. Magnite’s SSP is used for various formats such as display, video, and CTV ads.

-

Connected TV (CTV) and Video Advertising: One of the fastest-growing areas in digital advertising is CTV, and Magnite has positioned itself as a leader in this domain. Through its combination of video advertising solutions and CTV expertise, Magnite helps media owners monetise their premium video content across multiple platforms, including over-the-top (OTT) devices, smart TVs, and digital streaming services.

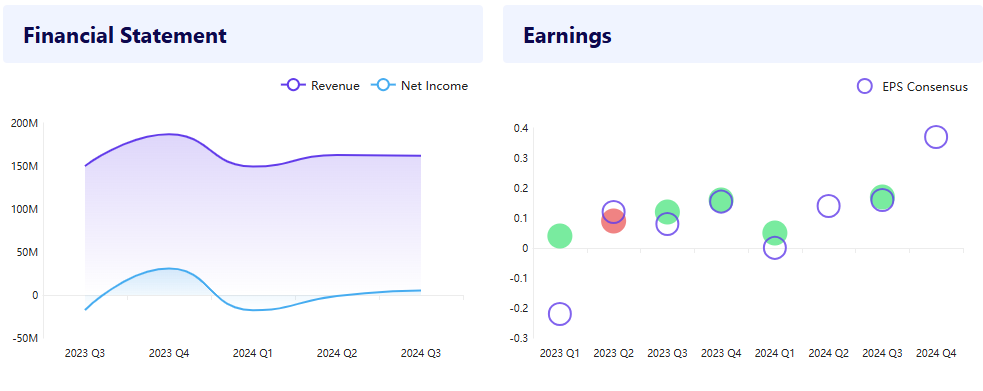

Recent Performance: As of the most recent quarterly results, Magnite has continued to show strong growth, particularly in the CTV and video segments. The company’s revenue has increased, driven by higher demand for programmatic advertising and an expanding footprint in video and CTV advertising markets. However, like many companies in the advertising space, Magnite's performance is sensitive to broader economic conditions and trends in digital advertising spending.

Key Financials and Performance Indicators:

Revenue Growth:

- Magnite's total revenue for Q3 2024 grew 22% year-over-year, driven by the continued strength of its CTV and video ad solutions.

- CTV revenue alone has seen significant growth, representing a large portion of the company's overall revenue, as advertisers shift spending from traditional TV to digital platforms.

- Magnite’s revenue is highly dependent on the volume of ad impressions across its platform, as well as the prices advertisers are willing to pay for those impressions.

Profitability:

- Magnite has focused on achieving profitability after its merger and restructuring efforts. As of the latest earnings report, the company reported a modest profit, but its margins have been under pressure due to higher operating costs associated with scaling its operations, investing in new technology, and expanding its CTV offerings.

- Gross margins typically hover in the 50%-60% range, reflecting the high demand for its programmatic advertising solutions.

EBITDA and Operating Income:

- The company reported positive adjusted EBITDA in recent quarters, indicating that its operations are becoming more efficient.

- Operating income has improved as Magnite reduces costs associated with legacy technologies and focuses on higher-margin businesses like CTV.

Cash Flow and Balance Sheet:

- Magnite maintains a strong balance sheet, with a solid cash position. This allows the company to continue investing in its growth initiatives, including product development and expanding its CTV offerings.

- Free cash flow has been positive, helping the company reinvest into its platform and make strategic acquisitions.

Growth Drivers:

1. Growth of CTV and Digital Video Advertising:

CTV has become one of the primary drivers of growth for Magnite. With the rise in streaming services and OTT devices, advertisers are increasingly shifting budgets away from traditional TV and towards digital and connected TV platforms. Magnite’s deep focus on CTV allows it to capture this growing market.

2. Programmatic Advertising Adoption:

Programmatic advertising continues to gain momentum as advertisers look for more efficient and data-driven ways to buy ad space. Magnite’s SSP platform is central to this trend, and the company has been able to capitalise on increased programmatic adoption, providing value to both publishers and advertisers.

3. Strategic Acquisitions:

Magnite has made several strategic acquisitions to bolster its position in video and CTV. For instance, the acquisition of SpotX in 2020 gave Magnite greater access to premium video ad inventory and strengthened its position in the fast-growing digital video market. Further acquisitions are expected as the company seeks to expand its technology stack and increase its market share.

4. International Expansion:

Magnite is continuing to grow its footprint internationally, particularly in regions such as Europe and Latin America. As digital ad spend rises in these regions, Magnite stands to benefit from an expanded client base and broader market reach.

Risks and Challenges:

-

Economic Sensitivity: Like most advertising companies, Magnite’s business is subject to fluctuations in overall advertising spending, which can be influenced by economic downturns, consumer confidence, and broader macroeconomic conditions. A slowdown in advertising budgets could negatively impact Magnite's growth prospects.

-

Competition: Magnite faces intense competition from other advertising technology firms such as The Trade Desk (TTD), PubMatic (PUBM), and Google’s advertising platform. The competition is especially fierce in programmatic advertising and video advertising, where there is significant pressure on pricing and margins.

-

Technological Disruption: The digital advertising space is rapidly evolving, and staying ahead of technological trends is critical. Magnite’s success depends on its ability to innovate and adapt its platform to new advertising trends, such as AI-driven advertising and machine learning algorithms for targeting and optimization.

-

Privacy and Regulatory Risks: The advertising industry is facing increasing scrutiny over data privacy, particularly in the wake of GDPR (General Data Protection Regulation) in Europe and similar laws in the U.S. Companies in the advertising tech space need to comply with complex regulations governing the collection, use, and sharing of consumer data. Non-compliance or adverse regulatory changes could negatively impact Magnite’s operations.

Valuation and Investment Outlook:

Valuation Metrics:

- As of the latest financial reports, Magnite’s stock trades at a Price-to-Sales (P/S) ratio of approximately 3.5x, which is relatively low compared to some of its peers in the programmatic advertising space, such as The Trade Desk (which trades at a P/S ratio of around 15x).

- Magnite’s Price-to-Earnings (P/E) ratio is not applicable due to its current focus on growth rather than profitability, though it is expected to move towards positive earnings as the company scales its operations and achieves more economies of scale.

Analyst Recommendations:

-

Bullish Sentiment: Our research analysts are generally optimistic about Magnite’s prospects, particularly in light of the strong growth in CTV and video advertising. The company’s strategic acquisitions and focus on programmatic ad solutions are expected to continue driving growth. Additionally, analysts believe that Magnite’s valuation is attractive compared to its competitors.

-

Bearish Concerns: Some analysts express concerns about the company’s margin pressures, competition, and reliance on continued high growth in programmatic and CTV markets. If growth in these segments slows down or the company faces challenges in execution, it could impact Magnite’s valuation and stock price.

Conclusion:

Magnite Inc. (NASDAQ: MGNI) represents a compelling opportunity for investors seeking exposure to the growing programmatic advertising and digital video sectors, particularly the rapidly expanding CTV market. The company’s strong position in the SSP space, combined with its strategic acquisitions and focus on innovation, makes it well-positioned for future growth. We have recommended a "BUY" rating on NASDAQ:MGNI at $16.15 with a target price of in between $18.05 to $20.00. However, investors should be aware of the risks posed by economic cycles, competition, and regulatory challenges in the advertising technology space.

With a solid balance sheet, strong revenue growth, and a promising growth trajectory in CTV and video advertising, Magnite is likely to remain an attractive option for long-term investors in the digital advertising ecosystem. However, investors should closely monitor the competitive landscape and any regulatory changes that may impact Magnite’s business.

Disclaimer: The information provided by Buttonwoodedge Consulting Ltd is intended as general information or an overview and does not consider your personal objectives, circumstances, or needs. Investment decisions are significant and should be made with care. If you are unsure about making a decision based on the analysis or overview presented in our reports, we recommend seeking personalized advice from a licensed adviser. Buttonwoodedge Consulting Ltd disclaims any liability for losses or damages resulting from actions taken based on this information.

RECENT POST

- When Tensions Rise in the…

- Stocks Turn Volatile After Trump…

- Combined Equity Analysis: Pan American…

- Year-End Markets in Focus: A…

- Wall Street Hits Pause: Strong…

- Global Markets at a Crossroads:…

- Stock Market Update: Notable Decliners…

- Earnings Turn Positive: Why Investors…

- This Week’s Top 5 Market…

- Snowflake Inc. Powers Ahead: Strong…

- Nvidia Eyes the Quantum Leap…

- Byrna Technologies Delivers Impressive Q1,…

- Crocs, Inc. (NASDAQ: CROX): A…

- Norwegian Cruise Line Holdings (NCLH):…

- Trump Signs Historic Bill to…

- Markets Respond to Trump's New…

- Magnite Inc. (NASDAQ: MGNI): A…

- Rising Demand for VanEck Defense…

- In-Depth Analysis of Pinterest (NYSE:…

- Marathon Digital Holdings (NASDAQ: MARA)…

- Novo Nordisk (NYSE: NVO) Drives…

- Is Semrush Holdings, Inc. (NYSE:SEMR)…

- Woodside Energy (ASX:WDS) Reports Strong…

- SoFi Technologies Inc (NASDAQ:SOFI): Redefining…

- British American Tobacco (LON:BATS) Reports…

- US Stocks Decline Amid Profit-Taking…

- Upcoming Quarterly Earnings and Growth…

- Outlook for the US stock…

- British Equities Rise Amid Hopes…

- Why Capital Growth is Crucial…

- Global M&A in 2H: A…

- Global stock markets take a…

- General Analysis of Adicet Bio,…

- Copyright © 2026 Buttonwood Edge All Rights Reserved