In-Depth Analysis of Pinterest (NYSE: PINS): Strong Financials, Competitive Pressures, and Growth Opportunities

In-Depth Analysis of Pinterest (NYSE: PINS): Strong Financials, Competitive Pressures, and Growth Opportunities

Pinterest Inc. | NYSE: PINS

Research Report | January 14 2025

1. Executive Summary

Pinterest Inc. (NYSE: PINS) is a social media platform that allows users to discover, share, and save creative ideas through images, videos, and other multimedia. The platform operates as a visual discovery engine, enabling users to explore a variety of categories, such as fashion, home décor, food, and DIY projects. Since its IPO in April 2019, Pinterest has focused on expanding its user base, improving user engagement, and growing its advertising business.

This report aims to provide a comprehensive analysis of Pinterest's business model, financial performance, competitive landscape, market trends, and investment outlook for the company.

2. Company Overview

Name: Pinterest Inc.

Stock Ticker: PINS

Founded: 2010

Headquarters: San Francisco, California

CEO: Bill Ready (since June 2022)

Industry: Social Media, Technology, Advertising

Revenue Model: Advertising-based

Platform: Web and Mobile

2.1 Business Model

Pinterest primarily generates revenue through advertising. Businesses pay to promote their products or services on the platform via "Promoted Pins," which are paid advertisements that blend seamlessly with organic content. Pinterest’s advertising solution includes targeting options based on user demographics, interests, and behaviors, making it a powerful tool for marketers to reach potential customers.

Pinterest's business model is based on two key elements:

- User Engagement: Pinterest offers a unique, visually-driven experience that encourages users to spend time on the platform discovering content, which in turn increases the effectiveness of its advertising products.

- Monetization through Ads: As user engagement grows, Pinterest capitalizes on this engagement by offering advertisers more granular targeting options and advanced features, including video ads and shopping integration.

3. Financial Performance

3.1 Revenue and Growth Trends

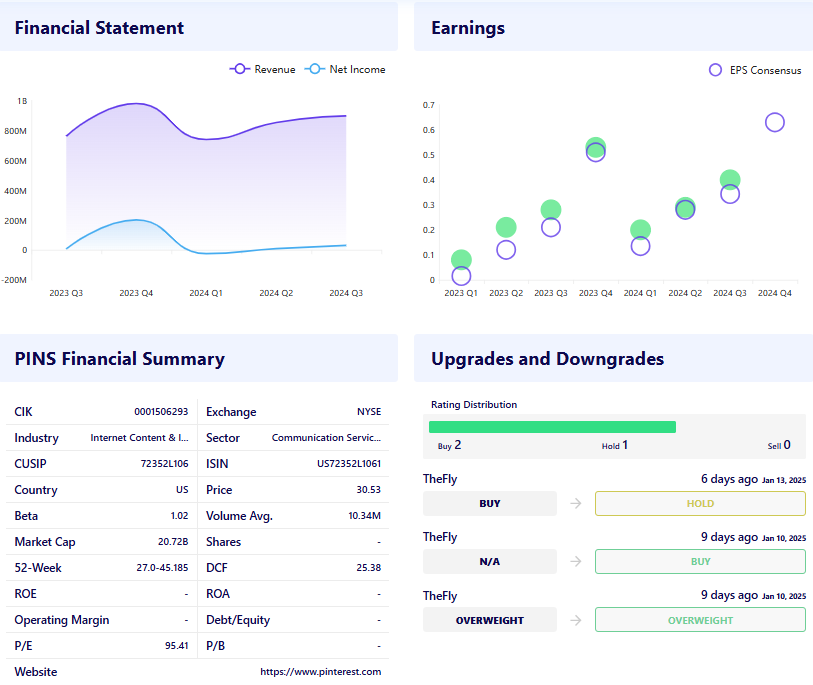

Pinterest's revenue model is centered around advertising, which has allowed the company to experience significant revenue growth. The company's key financial figures for the most recent fiscal periods are as follows:

|

Metric |

FY 2023 |

FY 2022 |

FY 2021 |

FY 2020 |

|---|---|---|---|---|

|

Revenue (in millions) |

$2,973 |

$2,667 |

$2,577 |

$1,694 |

|

Year-over-year growth (%) |

11.5% |

3.5% |

51.7% |

48.7% |

|

Net Income (in millions) |

$1,070 |

$144 |

$1,139 |

$288 |

|

Operating Income (in millions) |

$475 |

$103 |

$1,058 |

$446 |

|

Earnings per Share (EPS) |

$1.51 |

$0.22 |

$1.56 |

$0.43 |

In FY 2023, Pinterest achieved revenue growth of 11.5%, continuing a positive trend from the previous year. Although the company saw a dip in net income compared to the boom in FY 2021, Pinterest remains highly profitable, with strong margins.

3.2 Profitability Metrics

Pinterest has demonstrated the ability to generate consistent profits, with its operating income margins remaining robust. Profitability metrics for Pinterest are relatively healthy, especially given the growth in revenue and the increased spending on product development and innovation.

- Operating Margin: Approximately 16% in FY 2023, reflecting effective cost control despite increasing investments.

- Net Margin: Approximately 36% in FY 2023, indicating a strong ability to convert revenue into profit.

3.3 User Metrics

Pinterest’s active user base and engagement metrics are critical for evaluating its long-term revenue potential.

- Monthly Active Users (MAUs): 465 million MAUs as of Q4 2023. This number represents a slight decline from previous quarters, highlighting challenges in user growth, particularly in international markets.

- Average Revenue per User (ARPU): Pinterest's ARPU has increased consistently, reflecting higher advertising demand and enhanced monetization efforts.

4. Market Trends and Industry Overview

4.1 Industry Dynamics

The social media and digital advertising industries have experienced rapid growth over the last decade, with more businesses shifting their marketing budgets toward digital platforms. Within this broad market, Pinterest is positioned as a unique player due to its focus on visual discovery and user-generated content.

- Social Media Ad Spend: Digital advertising spend is expected to continue its rapid growth, with social media platforms capturing a large share. Pinterest, as a visual platform, faces increasing competition from other social media giants like Facebook, Instagram, and TikTok. However, Pinterest’s niche in lifestyle inspiration allows it to maintain a distinctive identity within the social media space.

- E-Commerce Integration: Pinterest has been integrating more shopping features into its platform, including shoppable pins and partnerships with e-commerce companies. This could boost its ad revenue growth and further enhance its value proposition to businesses.

4.2 Competitive Landscape

Pinterest faces competition from several major social media platforms, including:

- Meta Platforms Inc. (Facebook and Instagram): With its large user base and extensive advertising solutions, Meta is Pinterest’s most direct competitor. However, Pinterest's unique positioning in the discovery and inspiration space may limit direct competition.

- Snap Inc. (Snapchat): While Snapchat targets a younger demographic and focuses heavily on augmented reality and short-form video, it competes with Pinterest in terms of capturing attention from advertisers.

- TikTok: TikTok has grown exponentially in recent years and has become a formidable competitor in the short-form video and engagement-driven content space. As TikTok’s advertising model evolves, it could pose a significant challenge to Pinterest's market share.

- Google: Pinterest faces competition from search engines like Google, especially in the context of paid search ads. Google’s dominance in online search and advertising is a potential threat to Pinterest’s ability to attract advertisers.

4.3 Opportunities

- E-Commerce Growth: Pinterest's increasing focus on e-commerce offers significant opportunities for growth, particularly as more consumers turn to online shopping. Pinterest can capitalize on its shopping features and integrate with major online retail platforms.

- International Expansion: Pinterest has a substantial international growth opportunity, especially in emerging markets where social media adoption is increasing.

- Video Content: Pinterest’s move toward more video-based content could drive higher engagement and open new advertising formats for brands.

4.4 Risks

- Slowing User Growth: Pinterest has experienced challenges in growing its user base, particularly in its largest markets. The decline in MAUs is a potential red flag for long-term growth prospects.

- Competitive Pressure: Intense competition from platforms like TikTok and Instagram could impact Pinterest's ability to attract and retain users.

- Advertising Dependence: Pinterest remains heavily dependent on advertising revenue, which makes the company vulnerable to fluctuations in the advertising market and broader economic downturns.

5. SWOT Analysis

Strengths:

- Strong brand identity as a visual discovery engine.

- Consistent revenue growth with a focus on ad monetization.

- High profitability and strong margins.

- Increasing integration of shopping features, tapping into the e-commerce trend.

Weaknesses:

- Slower user growth compared to competitors.

- Heavy reliance on advertising revenue.

- Limited international penetration.

Opportunities:

- Expanding e-commerce capabilities.

- Increasing focus on video content could drive higher user engagement.

- New advertising products and partnerships with businesses.

Threats:

- Intense competition from platforms like Meta, Snapchat, and TikTok.

- Vulnerability to economic downturns that impact advertising budgets.

- Decline in organic user growth.

6. Investment Outlook

6.1 Valuation

As of 14TH January 2025, Pinterest’s stock trades at approximately $28 per share, with a market capitalization of around $20 billion. The price-to-earnings (P/E) ratio is relatively high compared to its competitors, reflecting investor optimism regarding Pinterest’s future growth prospects, especially in e-commerce and advertising.

6.2 Analyst Ratings

Our research analysts have recommended a “Buy” rating based on its profitability and potential for future growth in advertising and e-commerce. However, concerns around user growth and competitive pressures make it a stock with moderate risk.

6.3 Price Target

Our research analysts have set a price target range between $30 and $35 for Pinterest in the next 12 months, contingent on improved user growth and successful execution of its e-commerce and advertising strategies.

7. Conclusion

Pinterest has proven itself as a valuable player in the social media space, with a distinctive niche focused on visual discovery and inspiration. However, it faces several challenges, including slowing user growth and intense competition. The company's focus on expanding its e-commerce offerings, improving advertising solutions, and tapping into video content could provide avenues for continued growth.

Investors should weigh the company's strengths in profitability and advertising potential against risks related to user growth and competition. Given its strong financial position and growth prospects, Pinterest remains a stock worth monitoring for those looking for exposure to the digital advertising and e-commerce sectors.

Disclaimer: The information provided by Buttonwoodedge Consulting Ltd is intended as general information or an overview and does not consider your personal objectives, circumstances, or needs. Investment decisions are significant and should be made with care. If you are unsure about making a decision based on the analysis or overview presented in our reports, we recommend seeking personalized advice from a licensed adviser. Buttonwoodedge Consulting Ltd disclaims any liability for losses or damages resulting from actions taken based on this information.

RECENT POST

- When Tensions Rise in the…

- Stocks Turn Volatile After Trump…

- Combined Equity Analysis: Pan American…

- Year-End Markets in Focus: A…

- Wall Street Hits Pause: Strong…

- Global Markets at a Crossroads:…

- Stock Market Update: Notable Decliners…

- Earnings Turn Positive: Why Investors…

- This Week’s Top 5 Market…

- Snowflake Inc. Powers Ahead: Strong…

- Nvidia Eyes the Quantum Leap…

- Byrna Technologies Delivers Impressive Q1,…

- Crocs, Inc. (NASDAQ: CROX): A…

- Norwegian Cruise Line Holdings (NCLH):…

- Trump Signs Historic Bill to…

- Markets Respond to Trump's New…

- Magnite Inc. (NASDAQ: MGNI): A…

- Rising Demand for VanEck Defense…

- In-Depth Analysis of Pinterest (NYSE:…

- Marathon Digital Holdings (NASDAQ: MARA)…

- Novo Nordisk (NYSE: NVO) Drives…

- Is Semrush Holdings, Inc. (NYSE:SEMR)…

- Woodside Energy (ASX:WDS) Reports Strong…

- SoFi Technologies Inc (NASDAQ:SOFI): Redefining…

- British American Tobacco (LON:BATS) Reports…

- US Stocks Decline Amid Profit-Taking…

- Upcoming Quarterly Earnings and Growth…

- Outlook for the US stock…

- British Equities Rise Amid Hopes…

- Why Capital Growth is Crucial…

- Global M&A in 2H: A…

- Global stock markets take a…

- General Analysis of Adicet Bio,…

- Copyright © 2026 Buttonwood Edge All Rights Reserved