Mattel (NASDAQ: MAT): Resilient Growth, Strategic Innovation, and Strong Market Position in the Global Toy Industry

Mattel (NASDAQ: MAT): Resilient Growth, Strategic Innovation, and Strong Market Position in the Global Toy Industry

Mattel Inc. | NASDAQ: MAT

Research Report | January 22 2025

1. Executive Summary

- Company Overview: Mattel, Inc. is a leading global toy manufacturer and entertainment company, known for iconic brands such as Barbie, Hot Wheels, Fisher-Price, and American Girl. The company designs, manufactures, and markets products for children and families worldwide, including dolls, action figures, games, and educational toys.

- Market Position: Discuss the company’s position in the toy industry, its market share, and its role in the global toy market.

- Key Financial Highlights: Summarize key financial data like revenue, net income, and EBITDA from the most recent annual or quarterly report.

- Outlook: Present a brief outlook on the company’s growth potential based on current industry trends and financial performance.

2. Company Profile

-

History: A brief history of Mattel, including its founding (1945), major milestones, acquisitions (e.g., Fisher-Price, American Girl), and leadership changes.

-

Business Segments:

- Toys and Games: Focus on key brands like Barbie, Hot Wheels, Matchbox, Fisher-Price, and Thomas & Friends.

- Entertainment: Discuss Mattel's expansion into entertainment, including film, television, and digital media, leveraging its toy brands for cross-media initiatives.

- Licensing and Other Ventures: Explore any strategic partnerships or licensing deals (e.g., with films like "Barbie" 2023 or video games).

-

Corporate Governance: List key executives, board members, and their experience.

3. Financial Performance

-

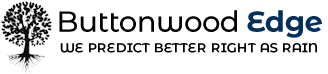

Revenue & Profit Trends:

- Overview of recent financial performance (revenue growth, profitability, and trends).

- Comparison of historical data (last 3-5 years) on revenue and profit margins.

-

Key Financial Ratios:

- Price-to-Earnings (P/E) Ratio: To gauge market valuation.

- Return on Equity (ROE): To assess profitability in relation to equity.

- Gross Margin & Operating Margin: To evaluate cost management and profitability.

- Debt-to-Equity Ratio: To understand the company's leverage.

-

Cash Flow: Analyze cash flow from operations, investments, and financing, and discuss how this impacts the company's liquidity.

4. Industry Overview

- Global Toy Market Trends: Discuss trends in the toy industry, such as the impact of digital toys, augmented reality, and the shifting preferences of children.

- Market Growth: Estimate market growth rates for the toy industry and Mattel’s prospects.

- Consumer Behavior: Discuss evolving consumer preferences, including sustainability and eco-friendly products, and how this is affecting Mattel’s product development.

5. Competitive Landscape

-

Competitors: Identify and discuss major competitors in the toy industry, including Hasbro, LEGO, and newer entrants like Roblox and other digital platforms.

- Market Share: Analyze Mattel’s position relative to its competitors.

- Competitive Advantages: Discuss Mattel’s brand strength (e.g., Barbie), innovation, and licensing deals that differentiate it from competitors.

- SWOT Analysis: Conduct a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for Mattel, based on its current market environment.

6. Strategic Initiatives

- Product Innovation: Highlight recent product innovations and launches, such as new Barbie dolls or Mattel’s efforts to diversify into adult-targeted toys or educational products.

- Digital Transformation: Discuss Mattel’s investment in digital toys, augmented reality, mobile games, and virtual platforms.

- Sustainability Initiatives: Address Mattel’s efforts in sustainability, such as using recycled materials for toy packaging and environmentally conscious manufacturing processes.

- Mergers and Acquisitions: Review any recent acquisitions (e.g., acquisition of MEGA Brands, licensing partnerships with film companies) and their strategic importance.

- Brand and Licensing Strategies: Explore how Mattel leverages its brands for licensing and collaborations with media companies, fashion brands, etc.

7. Risk Factors

- Economic Sensitivity: Assess how economic downturns or recessions could impact consumer spending on toys.

- Supply Chain Risks: Review supply chain challenges and disruptions, such as raw material shortages, logistical bottlenecks, or geopolitical risks.

- Competition & Innovation: Discuss the risk of new competitors entering the toy and digital space, and the importance of continuous innovation to remain competitive.

- Regulatory Risks: Address any potential regulatory changes affecting the toy industry, such as safety standards or international trade policies.

8. Valuation Analysis

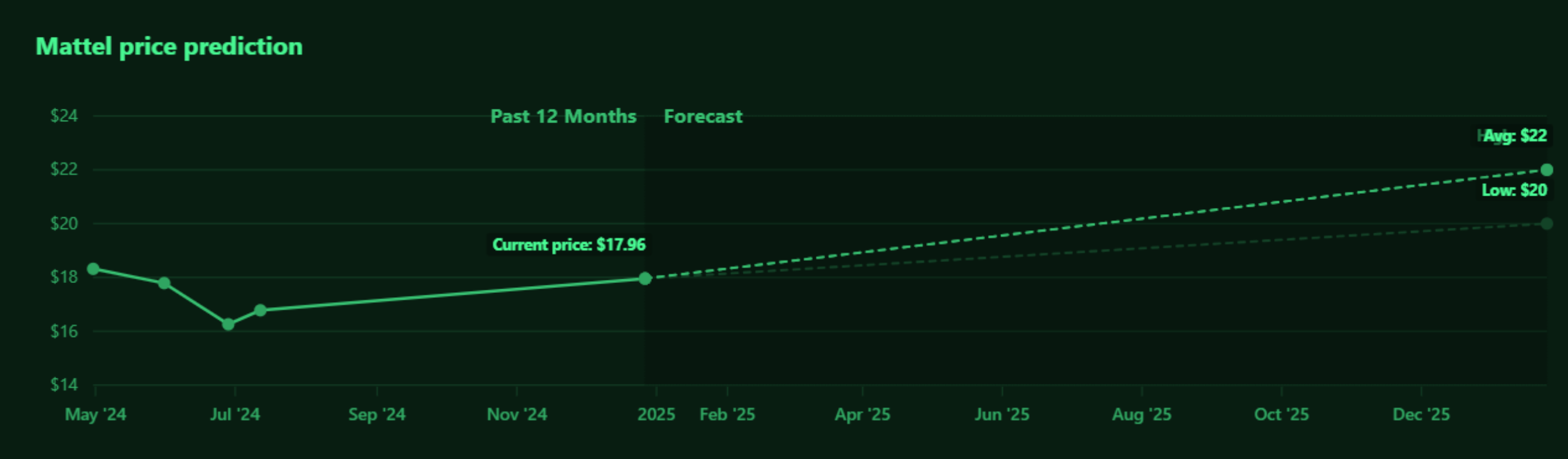

- Stock Performance: Review the recent stock price performance and the factors influencing Mattel’s valuation.

- Discounted Cash Flow (DCF) Analysis: If possible, provide a DCF valuation based on projected cash flows, cost of capital, and growth rates.

- Price Target: Based on valuation metrics, provide a price target and discuss whether the stock appears undervalued or overvalued in the market.

Conclusion

Based on the comprehensive analysis of Mattel, Inc. (NASDAQ: MAT), it is evident that the company occupies a strong position in the global toy industry, supported by iconic and well-established brands such as Barbie, Hot Wheels, Fisher-Price, and American Girl. Mattel’s ability to adapt to changing consumer preferences, invest in digital transformation, and expand into entertainment through licensing and media partnerships positions it as a resilient and forward-looking player in a highly competitive market.

From a financial perspective, Mattel has demonstrated solid revenue performance, although challenges remain in terms of margin pressures, cost management, and market saturation in some product categories. Despite these challenges, Mattel has made notable strides in innovation, product diversification, and sustainability efforts, which should bode well for long-term growth. Furthermore, the company’s investment in digital toys, augmented reality, and video games reflects a proactive approach to capitalizing on emerging trends in the entertainment and gaming sectors, allowing it to stay relevant to evolving consumer preferences.

In the face of ongoing economic uncertainties and supply chain risks, Mattel must continue to refine its strategies to maintain competitive advantages and mitigate risks. Its strong brand recognition, extensive intellectual property portfolio, and strategic partnerships provide a solid foundation for continued growth, but maintaining innovation and adapting to global shifts in consumer behavior will be crucial.

Considering the company’s market position, growth initiatives, and financial performance, Mattel presents an attractive investment opportunity for investors who are optimistic about the toy industry’s recovery and growth, particularly in the digital and entertainment sectors. However, in the short term, caution is warranted due to the volatility in consumer spending and broader economic conditions.

Recommendation: Our researchers have recommended a "Buy" wat the price of $17.92 with a target price of $20 - $22.04 ith a short to long-term outlook. Investors should monitor Mattel’s strategic moves in digital entertainment and sustainability while keeping an eye on external risks that may impact the toy sector. If the company continues to innovate and execute its strategic initiatives successfully, it could see sustained growth and improved shareholder value over the next several years.

This conclusion offers a more detailed and nuanced view of Mattel’s potential, factoring in both short-term challenges and long-term opportunities, and provides a clear investment recommendation based on the analysis.

Disclaimer: The information provided by Buttonwoodedge Consulting Ltd is intended as general information or an overview and does not consider your personal objectives, circumstances, or needs. Investment decisions are significant and should be made with care. If you are unsure about making a decision based on the analysis or overview presented in our reports, we recommend seeking personalized advice from a licensed adviser. Buttonwoodedge Consulting Ltd disclaims any liability for losses or damages resulting from actions taken based on this information.

RECENT POST

- Nvidia Eyes the Quantum Leap…

- U.S. Futures Slip as Markets…

- Byrna Technologies Delivers Impressive Q1,…

- Crocs, Inc. (NASDAQ: CROX): A…

- Norwegian Cruise Line Holdings (NCLH):…

- "Wendy's (NYSE: WEN) Sees Steady…

- Federal Reserve Chair Jerome Powell’s…

- Equinor ASA (EQNR) Quarterly Earnings…

- Trump Signs Historic Bill to…

- Markets Respond to Trump's New…

- Mattel (NASDAQ: MAT): Resilient Growth,…

- Magnite Inc. (NASDAQ: MGNI): A…

- Trump Unveils $500 Billion AI…

- Rising Demand for VanEck Defense…

- In-Depth Analysis of Pinterest (NYSE:…

- Marathon Digital Holdings (NASDAQ: MARA)…

- Trump’s Return to Office on…

- Novo Nordisk (NYSE: NVO) Drives…

- Is Semrush Holdings, Inc. (NYSE:SEMR)…

- Woodside Energy (ASX:WDS) Reports Strong…

- SoFi Technologies Inc (NASDAQ:SOFI): Redefining…

- British American Tobacco (LON:BATS) Reports…

- Jimmy Carter's Presidency: A Legacy…

- US Stocks Decline Amid Profit-Taking…

- Upcoming Quarterly Earnings and Growth…

- Outlook for the US stock…

- British Equities Rise Amid Hopes…

- A world in Flux -…

- Why Capital Growth is Crucial…

- September 10th 2024 - Oil…

- Global M&A in 2H: A…

- Global stock markets take a…

- General Analysis of Adicet Bio,…

- On 22 May 2024 Nvidia…

- Copyright © 2025 Buttonwood Edge All Rights Reserved