"Wendy's (NYSE: WEN) Sees Steady Growth Amid Strategic Global Expansion and Digital Innovation"

"Wendy's (NYSE: WEN) Sees Steady Growth Amid Strategic Global Expansion and Digital Innovation"

Research Report on NYSE: WEN (The Wendy's Company)

February 19, 2025

Ticker Symbol: WEN

Exchange: NYSE

Company Name: The Wendy's Company

Industry: Quick Service Restaurants (QSR)

Sector: Consumer Services

Headquarters: Dublin, Ohio

Founded: 1969

CEO: Todd Penegor

1. Business Overview

The Wendy's Company (NYSE: WEN) is one of the largest quick-service restaurant (QSR) chains in the world. Known for its hamburgers, chicken sandwiches, and signature Frosty dessert, Wendy's operates more than 7,000 locations worldwide. The company has evolved to include a wide variety of menu items, including salads, sides, beverages, and breakfast offerings. Wendy's has a significant presence in North America, but it also operates internationally, with a growing presence in key global markets.

Business Segments: Wendy’s operates through three primary segments:

- Wendy's U.S. – The company’s core business, comprising the majority of revenue and store locations.

- Wendy's International – Includes company-owned and franchised restaurants outside the U.S. and Canada.

- Global Real Estate & Development – This segment focuses on property development and franchising, contributing to the growth and scalability of the brand.

2. Recent Financial Performance

Revenue

- FY 2024: $2.25 billion (up 2.98% from 2023)

-

FY 2023: $2.18 billion

Wendy's has experienced consistent growth in revenue, driven by the expansion of its breakfast menu, digital platforms, and the addition of new restaurants.

Net Income

- FY 2024: $194.36 million (down 4.93% from 2023)

-

FY 2023: $204.12 million

Despite growth in revenue, net income declined slightly, reflecting challenges with operational costs and strategic investments in new ventures.

Earnings Per Share (EPS)

- FY 2024: $0.84

-

FY 2023: $0.89

The decline in EPS mirrors the overall decrease in net income, but the company has been actively working to maintain profitability through store closures and restructuring.

Dividend and Payouts

- Wendy's has a strong history of returning value to shareholders through dividends. For the fiscal year 2024, the dividend payout was around $0.60 per share, representing a consistent and reliable return for long-term investors. The dividend yield has generally hovered around 2.5% to 3%.

3. Stock Performance and Analyst Insights

Current Stock Price (as of February 2025):

- Price: $14.99

- Market Cap: Approx. $4.15 Billion

Price Target and Analyst Ratings

- Our Analyst Consensus: Moderate Buy

- 12-Month Price Target: $19.32 (upside potential of 28.89%)

Wendy's stock is currently rated as "Moderate Buy" for those interested in the potential growth from new initiatives, including their breakfast offerings and international expansion. However, concerns around increasing operational costs and the competitive QSR landscape have kept analysts cautious.

4. Recent Developments and Strategic Initiatives

Global Expansion

Wendy's has made substantial investments in expanding its presence outside the United States. The company has opened numerous locations in international markets such as China, the UK, and the Middle East. This expansion is expected to drive long-term growth, although international markets can present challenges in terms of local competition and consumer preferences.

Focus on Digital and Delivery

Wendy's has heavily invested in digital technology, including mobile apps, online ordering, and delivery partnerships. This strategy has helped the company better compete in the increasingly digital-driven restaurant industry. It is also enhancing its loyalty program to encourage repeat customers.

Breakfast Menu

Since launching its breakfast menu in 2020, Wendy’s has seen positive reception, with breakfast sales contributing to overall revenue growth. The brand has continued to refine its offerings to cater to a broader customer base looking for a fast, quality breakfast alternative.

Store Closures and Restructuring

In an effort to improve operational efficiency, Wendy's announced in late 2024 that it would close several underperforming U.S. locations. This aligns with the company’s strategy of focusing on profitability and streamlining operations. While this may initially reduce revenue, it’s aimed at improving long-term returns and margins.

5. Competitive Positioning

Industry Landscape

Wendy's competes in the highly competitive QSR industry, with major players such as McDonald’s, Burger King, Taco Bell, and Chick-fil-A. While Wendy's differentiates itself with high-quality fresh ingredients (not frozen beef), and its signature Frosty dessert, it faces challenges from the proliferation of healthier eating trends and the growing demand for plant-based options.

Competitive Strengths:

- Brand Recognition: Wendy's has a strong global brand presence, known for its innovative marketing, especially on social media.

- Product Quality: Known for using fresh ingredients, Wendy's positions itself as a higher-quality QSR option compared to some competitors.

- Digital Innovations: The company’s focus on mobile app integration, delivery, and customer loyalty programs has enhanced its competitive position.

Competitive Weaknesses:

- Operational Costs: Rising costs for raw materials, labor, and logistics have put pressure on profit margins.

- International Market Penetration: Wendy's faces significant competition in overseas markets, especially from established global chains like McDonald’s and KFC.

6. Investment Considerations

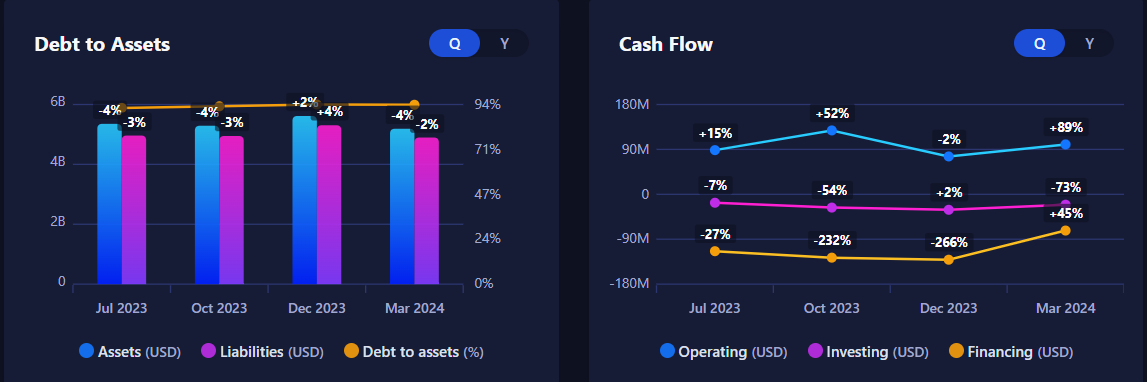

Wendy’s presents a balanced investment profile. On the positive side, the company’s steady growth, competitive market positioning, and international expansion provide a solid foundation for long-term success. Additionally, the company’s strong cash flow and dividend payments make it an attractive option for income-seeking investors.

However, the company faces some operational challenges, particularly related to cost inflation and the competitive nature of the QSR industry. Investors should also consider the risks associated with international expansion, especially in markets with intense local competition and regulatory challenges.

Conclusion:

Wendy's remains a solid investment in the quick-service restaurant space. For growth-focused investors, the stock may offer long-term potential, especially with its ongoing global expansion and innovation in the breakfast and digital segments. For those focused on stability, the dividend yield provides a relatively consistent return. However, the potential for short-term volatility due to macroeconomic factors and competitive pressures should be factored into any investment decision.

7. Key Risks

- Inflationary Pressures: Rising food and labor costs could continue to squeeze margins.

- Competitive Threats: Aggressive pricing and marketing from competitors like McDonald's and Chick-fil-A could erode market share.

- International Expansion Risk: The risks associated with expanding in international markets, including economic instability and consumer preferences, pose challenges to growth.

8. Conclusion

Wendy’s presents a unique opportunity for investors seeking exposure to the QSR industry. Its solid growth trajectory, strategic international expansion, and strong brand recognition position it well for long-term success. However, as with all investments, potential investors should weigh the competitive landscape and macroeconomic risks before making decisions.

Disclaimer: The information provided by Buttonwoodedge Consulting Ltd is intended as general information or an overview and does not consider your personal objectives, circumstances, or needs. Investment decisions are significant and should be made with care. If you are unsure about making a decision based on the analysis or overview presented in our reports, we recommend seeking personalized advice from a licensed adviser. Buttonwoodedge Consulting Ltd disclaims any liability for losses or damages resulting from actions taken based on this information.

RECENT POST

- Nvidia Eyes the Quantum Leap…

- U.S. Futures Slip as Markets…

- Byrna Technologies Delivers Impressive Q1,…

- Crocs, Inc. (NASDAQ: CROX): A…

- Norwegian Cruise Line Holdings (NCLH):…

- "Wendy's (NYSE: WEN) Sees Steady…

- Federal Reserve Chair Jerome Powell’s…

- Equinor ASA (EQNR) Quarterly Earnings…

- Trump Signs Historic Bill to…

- Markets Respond to Trump's New…

- Mattel (NASDAQ: MAT): Resilient Growth,…

- Magnite Inc. (NASDAQ: MGNI): A…

- Trump Unveils $500 Billion AI…

- Rising Demand for VanEck Defense…

- In-Depth Analysis of Pinterest (NYSE:…

- Marathon Digital Holdings (NASDAQ: MARA)…

- Trump’s Return to Office on…

- Novo Nordisk (NYSE: NVO) Drives…

- Is Semrush Holdings, Inc. (NYSE:SEMR)…

- Woodside Energy (ASX:WDS) Reports Strong…

- SoFi Technologies Inc (NASDAQ:SOFI): Redefining…

- British American Tobacco (LON:BATS) Reports…

- Jimmy Carter's Presidency: A Legacy…

- US Stocks Decline Amid Profit-Taking…

- Upcoming Quarterly Earnings and Growth…

- Outlook for the US stock…

- British Equities Rise Amid Hopes…

- A world in Flux -…

- Why Capital Growth is Crucial…

- September 10th 2024 - Oil…

- Global M&A in 2H: A…

- Global stock markets take a…

- General Analysis of Adicet Bio,…

- On 22 May 2024 Nvidia…

- Copyright © 2025 Buttonwood Edge All Rights Reserved